Cannabis entrepreneurs know that location is everything. Each state has its own laws, climate, market conditions, and opportunities that can make or break a cultivation venture. In this in-depth guide, we highlight ten of the best U.S. states for cannabis cultivation (in no particular order): California, Oklahoma, Michigan, New Mexico, Massachusetts, Oregon, Maine, Missouri, Colorado, and Alaska.

We’ll explore each state’s medical and recreational cultivation laws, plant limits, licensing setup, growing conditions (indoor vs. outdoor), wholesale prices, craft market potential, home-grow rules, and overall market outlook. Whether you’re a commercial grower or a craft connoisseur, these states offer some of the most cultivation-friendly environments in 2025.

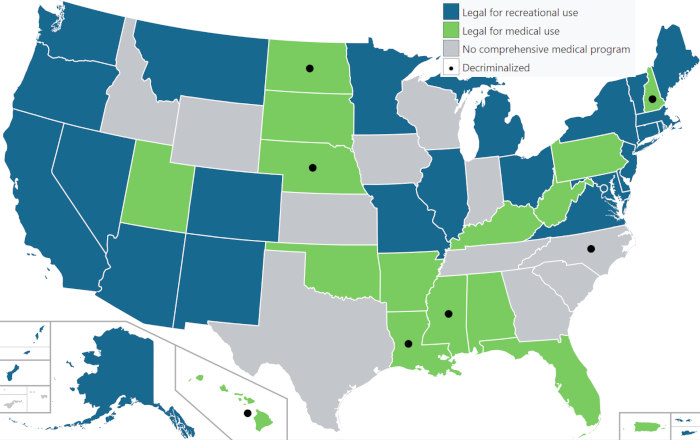

Map of U.S. showing cannabis legality by state (blue = adult-use legal, green = medical only). All ten states discussed here are among the most cultivation-friendly for growers as of 2025.

At-a-Glance Comparison of Top Cannabis States

To kick things off, here’s a quick comparison table of key metrics for each state:

| State | Legal Status | Home Grow Limit | Climate Suitability | Avg. Wholesale Price (2023) | Licensing Ease | Market Outlook |

|---|---|---|---|---|---|---|

| California | Rec & Med (since 2016) | 6 plants (per residence) | Mediterranean in many regions (outdoor-friendly) | ~$844/lb (flower) | Open licensing; local approval needed | Huge market, oversupplied, high taxes |

| Oklahoma | Med only (since 2018) | 6 mature & 6 seedlings (patients) | Hot summers, short winters (greenhouse recommended) | ~$1,031/lb | Very easy (no cap; moratorium until 2026) | Massive oversupply, awaiting rec legalization |

| Michigan | Rec & Med (since 2018) | 12 plants (per residence) | Seasonal climate (indoor/greenhouse preferred) | ~$902/lb | Open licensing; legacy caregiver culture | Growing market, price compression |

| New Mexico | Rec & Med (since 2021) | 6 mature & 6 immature (12/home) | Desert climate (ideal for outdoor/greenhouse) | ~$1,100/lb | Tiered licences (open entry; no state cap) | Oversupplied, low prices, adjusting |

| Massachusetts | Rec & Med (since 2016) | 6 plants (12 per household) | New England climate (short outdoor season, indoor common) | ~$1,129/lb | Moderate (no state cap; local host approval) | Expanding market, falling prices |

| Oregon | Rec & Med (since 2015) | 4 plants (per residence) | Coastal/mild in west; ideal outdoor in southern OR | ~$1,047/lb | Easy entry (low fees; per capita licensing) | Mature market, oversupplied & low prices |

| Maine | Rec & Med (since 2016) | 3 mature, 12 immature (per adult) | Cool climate (short season; greenhouse or indoor favored) | High retail, wholesale declining (51% price drop since 2020) | Small-tier licenses; craft-friendly | Craft scene strong, med oversupply pressures |

| Missouri | Rec & Med (since 2022) | 6 flowering + 6 immature + 6 clones (with permit) | Humid continental (indoor advised for quality) | ~$2,066/lb | Limited licenses (caps; new micro licenses) | Booming new market, high demand/prices |

| Colorado | Rec & Med (since 2012) | 6 plants (12 per home) | High-altitude semi-arid (short outdoor season) | ~$835/lb | Open market; very established industry | Saturated, rock-bottom prices, stable regs |

| Alaska | Rec & Med (since 2015) | 6 plants (3 mature) (12 per home) | Subarctic; mostly indoor grows (short summers) | ~$2,375/lb | Open; “Limited” 500 sq ft micro licenses | Small, isolated market, very high prices |

As the table shows, each of these states brings something unique to the table for cannabis cultivators—from California’s legendary growing culture to Missouri’s red-hot new market. Below, we dive into each state in detail, with an enthusiastic eye toward what makes it a cannabis grower’s paradise.

California – The Cannabis Cultivation Capital 🌴

California is often considered the cannabis cultivation capital of the U.S., with a long history of marijuana growing (thanks to the Emerald Triangle’s legacy farms) and a massive consumer market. Recreational cannabis was legalized in 2016, and the state already had a robust medical program since 1996.

Adult-use cultivation laws allow any adult 21+ to grow up to 6 plants at home for personal use. (Medical patients can grow more than 6 if a doctor recommends, although local ordinances may impose additional restrictions.) Commercial cultivation is legal and regulated statewide—but keep in mind, many cities and counties have their own rules or bans, so you must find a friendly locality to set up operations.

Cultivation limits and licensing

California’s licensing structure is tiered by canopy size, accommodating everything from small craft farms to large-scale grows. For example, there are specialty cottage licenses for tiny grows (as small as 25 outdoor plants or 500 sq ft indoor) and standard licenses for larger operations. Currently, there is no statewide cap on the number of cultivation licenses—thousands have been issued—but the bottleneck is often at the local level (around 60% of municipalities still ban commercial cannabis activity). License fees scale with size; a small outdoor farm’s annual fee might be a few thousand dollars, whereas a medium indoor facility’s fee can run tens of thousands.

Accessibility tip: Compared to limited-license states, California is relatively open—if you can secure local approval and meet state requirements, you can get a license. Just be prepared for extensive compliance (environmental impact studies, track-and-trace (Metrc) tagging, etc.) and hefty state and local taxes.

Growing conditions

California’s climate is world-class for cannabis, especially for outdoor and greenhouse cultivation. Coastal and inland areas offer a Mediterranean climate—warm dry summers and fall harvest seasons that are perfect for growing potent, sun-grown flower. Regions like Humboldt, Mendocino, and Trinity (the Emerald Triangle) are legendary for producing top-quality outdoor bud thanks to ideal latitude and climate. Southern California’s climate can also support outdoor grows, though water scarcity and hotter temperatures in some areas make indoor or mixed-light greenhouses more common in the south.

Overall, California growers have the luxury of choice: you can grow outdoors on a sunny hillside, cultivate indoors in a high-tech facility in the city, or do a bit of both with light-deprivation greenhouses. The state’s diverse microclimates allow year-round cultivation if you plan properly (multiple harvests via indoor or light dep). One caveat: wildfires and droughts have posed challenges in recent years, so outdoor growers must consider fire safety and water supply.

Wholesale prices and profitability

California’s cannabis market is huge but fiercely competitive. After legalization, overproduction led to a supply glut and price drops. At one point during the pandemic, wholesale flower in CA fetched over $2,000 per pound, but by 2023 it had plummeted to an average of ~$844/lb. Some outdoor-grown pounds have even sold for well under $500 in oversupplied seasons.

As of mid-2024, prices showed signs of stabilizing around ~$1,000–$1,200 per lb for average-quality flower, as many small farmers have bowed out and supply adjusts. Cultivators who survive tend to be either ultra-efficient large producers (who can profit on volume with low margins) or craft growers targeting the premium end of the market.

Profitability in California is tough but achievable—the key is carving out a niche (e.g. organic sungrown craft bud with a story, or boutique indoor with designer genetics) and navigating the high costs. Taxes on growers (a cultivation tax was repealed in 2022, easing some burden) and hefty retail taxes mean growers often receive only a slice of what consumers pay. Still, California’s market size (over $5 billion in annual sales) means high potential upside if you can scale and stand out.

Viability for craft growers

California’s long cannabis culture supports a connoisseur market that appreciates craft quality. Small-batch premium cannabis can thrive here, especially with the state’s new appellations program (allowing regions to market specialty terroir cannabis, similar to wine regions). However, craft farmers face an uphill battle against big farms and an illicit market that still undercuts legal prices. Regulatory costs and testing requirements apply equally to a 5,000 sq ft farm and a 50,000 sq ft farm, which can squeeze the little guys. In response, some independent growers have formed co-ops or brand alliances to survive.

Enthusiastic consumers in California do seek out exotic strains and top-shelf flower, giving well-branded craft products a chance to command higher prices. The viability is there, but craft growers must be business-savvy and quality-obsessed to make it.

Home grow rules

For personal use, Californians 21 and over may cultivate up to 6 plants at their residence (indoors or outdoors). This limit is per household not per person—so even if you have three roommates, the cap is 6 plants total. Medical patients can apply for higher plant counts; in practice, many counties allow patients or caregivers to grow a dozen or more plants if needed, but it varies. Home growers cannot use volatile solvents to process extracts, and the plants must be hidden from public view and secure. California’s home-grow allowance is fairly generous compared to some states, though not as high as Michigan’s 12-plant limit.

Market outlook and stability

California’s cannabis market is maturing amidst challenges. Regulatory stability is moderate—the state consolidated oversight under the Dept. of Cannabis Control (DCC) and continues tweaking rules to streamline licensing and combat the illicit trade. The biggest issue is economics: persistent illicit sales (which avoid the high taxes) and oversupply have pressured legal operators. Many small cultivators have surrendered licenses in the past two years due to low prices and high costs.

On the positive side, the exodus of some producers might eventually bring supply-demand into better balance, lifting wholesale prices from their rock-bottom. California will likely remain a cannabis powerhouse with a rich culture and huge consumer base. If and when federal legalization allows interstate commerce, California’s renowned cannabis could become a major export—a hopeful prospect for growers hanging on.

In the meantime, the state is focused on supporting equity applicants, cracking down on illegal grows, and perhaps cutting taxes to help legal businesses survive. Bottom line: California offers unparalleled opportunities for those who can navigate its complexities—it’s a thrilling but challenging state for cannabis growers, with legendary potential and equally legendary competition.

Oklahoma – The Wild West of Weed (Medical-Only) 🤠

Oklahoma might surprise some with its inclusion on this list—after all, it hasn’t legalized adult-use (recreational) cannabis (a 2023 ballot question for rec was defeated). But its medical marijuana program is so accessible and cultivation-friendly that Oklahoma has become a boom state for growers.

Since legalizing medical in 2018, Oklahoma issued an unprecedented number of grower licenses, leading to a free-market frenzy in cannabis cultivation. There are no hard caps on licenses or canopy in the medical program, meaning virtually anyone who meets basic requirements (21+, 2-year residency until recently, clean record, and a $2,500 license fee) could start a commercial grow. This low barrier to entry and light regulation earned Oklahoma a “Wild West” reputation in the cannabis world.

Cultivation laws and home grow

For licensed patients, Oklahoma allows home cultivation of 6 mature marijuana plants plus 6 seedlings for personal medicinal use. This is fairly generous and on par with many rec-legal states. There’s no recreational home grow since non-patients can’t legally possess cannabis. But obtaining a medical card in Oklahoma is famously easy—there are no specific qualifying conditions, it’s left to doctor discretion. As a result, over 347,000 patients have registered (nearly 10% of the state’s population), effectively making cannabis accessible to any adult willing to get a card. Thus, home grows flourish under patient licenses.

On the commercial side, cultivation limits are essentially market-driven: a grower license permits you to grow as much as you can sell, subject to compliance like seed-to-sale tracking. Some growers operate small indoor rooms, while others have enormous outdoor fields or greenhouse complexes on rural land. Oklahoma became a free-for-all where even modest entrepreneurs could start a cultivation business—a stark contrast to states with million-dollar license costs.

Licensing and structure

At its peak in 2021, Oklahoma had a stunning >9,400 licensed growers—an absolutely huge number relative to its population. (For comparison, California has only a few thousand licensed cultivators serving a much larger market.) There were so many operators that by 2022 the state legislature hit the brakes: they enacted a moratorium on new grow licenses until at least August 2026. Existing licenses remain valid (around 3,940 grows were still active as of mid-2023), but no new entrants can join until the moratorium lifts. The aim was to combat oversupply and illegal diversion.

Licensing fees ($2,500 initial, plus background checks and such) are low, and there are no explicit tiers—whether you grow 100 plants or 10,000, it’s the same type of license. This accessibility created what many call a grower “gold rush” from 2018–2021. Now, with the pause on new licenses, the chaos is settling slightly—but those thousands of existing farms are still competing fiercely.

Growing conditions

Oklahoma’s climate is a bit of a mixed bag for cannabis. On one hand, it has long, hot summers and plenty of sunshine which can be great for outdoor cultivation (especially for hardy, heat-tolerant strains). Many growers have taken advantage of relatively cheap land to do outdoor or greenhouse grows. On the other hand, Oklahoma’s weather can be extreme: scorching temperatures over 100°F in summer, violent storms, heavy winds (even tornadoes), and an early autumn cold snap risk. Outdoor growers have to plan for irrigation during dry spells and possibly use light-deprivation or early-finishing varieties to avoid the fall frosts. Humidity can be high at times, which means mold can threaten outdoor crops if rains come at harvest time.

As a result, a lot of commercial cultivators opt for greenhouses or indoor warehouses, where they can control the environment. Indoor growing also helps produce the high-THC, top-shelf buds that dispensaries and consumers often prefer. Electricity costs in Oklahoma are moderate, and the state’s central location isn’t as prone to catastrophic wildfires like the West Coast, which is a plus. Overall, Oklahoma is suitable for cultivation year-round (with indoor grows) and has a decent outdoor season, though not as ideal as the West Coast’s.

Wholesale prices and profitability

In a word, oversupply. Oklahoma’s open floodgates led to an absolute glut of product. By 2023, cultivators were producing 64 times more cannabis than the legal market could consume! With supply outstripping demand so dramatically, wholesale prices tanked. Oklahoma has seen pounds of mid-grade flower sell for shockingly low prices (reports of $500 or even less for outdoor pounds circulated among growers).

The average wholesale flower price in 2023 was about $1,030/lb—which might not sound terrible, but that average likely reflects some higher-quality indoor buds propping it up. In practice, many growers were sitting on unsold inventory or resorting to selling on the illicit out-of-state market (which enforcement officials have been cracking down on).

Profitability for Oklahoma growers has been very challenging unless they operate at ultra-low cost. Land and labor are cheaper than in many states, but when you’re competing with thousands of other local farms and illicit suppliers, it becomes a race to the bottom. Some small growers have folded, unable to get rid of their harvests except at loss-leading prices. Paradoxically, a few elite indoor producers still command better prices by selling top-shelf exotic strains in the medical dispensaries for premium patients—so if you differentiate by quality, you can eke out a niche.

Also, since the license moratorium, no new competitors can join, which might gradually reduce supply and help survivors. But until patient demand or legal outlets grow significantly, Oklahoma’s market will likely remain oversaturated, keeping prices low. (It doesn’t help that without recreational legalization, the total consumer pool is limited to card-holders.)

Viability for craft growers

Oklahoma’s market has not been particularly kind to “craft” in terms of pricing—patients often opt for whatever is affordable (and there’s plenty of cheap weed). However, there is a subset of patients/consumers who seek higher-quality, organically grown, small-batch flower and are willing to pay a bit more.

Craft cultivators in Oklahoma can leverage direct relationships with dispensaries to feature boutique strains or sun-grown, sustainable bud. The state doesn’t have a long-established cannabis culture like the West Coast, but it’s developing one rapidly. Because literally thousands of ordinary Oklahomans jumped into growing, there is a community of passionate cultivators sharing knowledge and striving for quality.

Some craft-minded growers have banded together in cooperatives or marketed their products at cannabis cups and events to stand out. In short, craft cultivation is possible but tough—you’ll need to educate consumers on why your product is premium and hope the dispensary doesn’t just push low-priced wholesale from a big farm. The silver lining: with rec not legal, there’s no influx of out-of-state corporate players yet, so it’s mostly local, small businesses competing (all craft, in a sense).

Home grow rules (personal use)

Only medical patients (and their designated caregivers) can legally grow cannabis at home in Oklahoma. As noted, they can have 6 mature and 6 seedling plants. These home grows must be on property owned by the patient or with the owner’s written permission. There aren’t elaborate home-inspection regimes—enforcement is complaint-based, meaning as long as you keep it discreet and within limits, patients generally don’t face issues growing their allowed plants.

No recreational home grow is allowed currently; if you don’t have a medical card, any cultivation is illegal. Given how easy it is to get a card, many would-be home hobbyists just go that route. It’s worth noting that Oklahoma’s patient possession limits are high (e.g. 8 ounces of flower allowed at home, far more than most states’ 1-2 oz limits), which complements the home-grow allowance nicely.

Market outlook and regulatory stability

Oklahoma’s cannabis future is at a crossroads. On one hand, the state showed laissez-faire enthusiasm in 2018-2021, creating arguably the most free-market cannabis system in the country. On the other hand, that freedom led to problems: oversupply, concerns about illegal export (Oklahoma-grown product traced as far as New York and elsewhere), and even involvement of organized crime in some grow operations (authorities have busted farms tied to criminal organizations).

The regulatory response has been to tighten up: implement seed-to-sale tracking, increase inspections, and enact the license moratorium. So, regulatory stability is evolving—from wild west towards more control. The moratorium until 2026 means existing businesses have a chance to stabilize and perhaps the state can weed out bad actors.

Will Oklahoma legalize recreational? That’s a big question. Voters rejected it in March 2023, but advocates may try again or push through the legislature in coming years. If/when rec comes, the state might impose more structure (possibly caps or stricter zoning) to avoid a repeat oversupply scenario—or maybe they’ll continue the free-market approach. For now, the outlook for growers is cautious: expect continued low prices and fierce competition, but also a sort of survival-of-the-fittest that could leave a core of experienced, efficient growers by 2025.

If you’re an Oklahoma grower who can hang on until rec legalization (which would expand the customer base massively), you could be in a prime position to capitalize. The state’s low tax, pro-business attitude is a plus if managed properly. Just go in with eyes open: it’s easy to start growing in Oklahoma, but not easy to profit. Yet for many, the passion and potential future payoff make it worthwhile, keeping Oklahoma on the map as one of the most intriguing places to grow cannabis.

Michigan – Midwest Craft and Caregiver Legacy 🚗

Michigan has emerged as one of the most robust cannabis markets in the Midwest, offering big opportunities to growers both large and small. The state legalized medical marijuana in 2008 and adult-use (recreational) in 2018, giving it a well-established industry and community of cannabis enthusiasts.

Michigan’s approach to cultivation is relatively open: it has a mix of license tiers (including options friendly to smaller growers) and one of the most generous home-grow allowances in the country. It’s also a state with a proud “craft cannabis” legacy, thanks in part to its early caregiver system that fostered small-scale, high-quality growing.

Cultivation laws (medical vs. recreational)

Michigan’s adult-use law (Proposal 1, passed in 2018) allows any adult 21+ to grow up to 12 plants at home for personal use—that’s double the limit of most states, making Michigan a home-grower’s haven. You can also possess up to 10 ounces of your harvest at home (and up to 2.5 ounces in public).

On the commercial side, Michigan has a tiered licensing system: Class A cultivators can grow up to 100 plants, Class B up to 500, Class C up to 2,000, and there’s even an “excess grower” license that lets a company stack multiple Class C licenses for very large operations. Uniquely, the 2018 law also created a Microbusiness license, which allows a single business to grow up to 150 plants and process and sell their own product (a vertically integrated craft operation).

For medical growers (under the older 2008 system), registered caregivers could grow up to 12 plants for each of up to 5 patients, plus 12 for themselves—so a caregiver could have as many as 72 plants. This caregiver model (which wasn’t tightly overseen by the state at first) produced a vibrant gray-market of boutique cannabis that predates recreational sales. In recent years, regulators have been phasing out caregivers’ ability to supply the licensed market, steering them to become licensed growers instead. Still, the legacy influence remains in Michigan’s cannabis culture.

Licensing requirements and structure

Michigan’s commercial licensing is fairly accessible compared to “limited license” states. There is no statewide cap on the number of licenses, and as of late 2023, the state had issued hundreds of grow licenses (roughly 950 active adult-use cultivation licenses, plus dozens of “excess grow” permits for big operators).

The application process involves state vetting (through the Cannabis Regulatory Agency) and usually requires securing a location in a municipality that permits cannabis businesses. Many towns opted out initially, making real estate in “green zones” competitive, but over time more areas have opened up. Fees are moderate: an application fee around $6,000 and license fees that range from $4,000 for Class A to $40,000 for Class C, etc., plus renewal fees (often these get reduced for social equity applicants). Because Michigan welcomes different scales of grows, you have everyone from small family farms (just 100 plants in a barn) to huge greenhouse complexes (stacking multiple Class C licenses) operating simultaneously. This diversity is great for innovation but also means competition is intense.

Another important aspect is local approval—each city or township can limit the number of growers or decide not to allow them at all, which can be a hurdle in more conservative areas. Overall, Michigan’s licensing structure has allowed a relatively free market to flourish, especially compared to tightly controlled states like Illinois (its neighbor).

Climate and growing conditions

Michigan’s climate presents some challenges—it’s no California—but it’s workable for cannabis with the right approach. The state has cold winters and a temperate summer. Outdoor cultivation is limited to essentially one growing season: planting in spring after the last frost (May) and harvesting by mid-to-late fall. Some growers do outdoor “light dep” (light deprivation techniques to force earlier flowering and avoid the fall frost/mold season). The humid continental climate, especially in the lower peninsula, means summers can be humid, and fall brings rain, which can cause mold issues on buds if not harvested in time.

As a result, indoor cultivation is king in Michigan for consistent, year-round production of high-quality flower. The state has many retrofitted warehouses and even repurposed industrial buildings turned indoor farms. Greenhouse cultivation is also popular—it leverages free sunlight in summer but allows environmental control. Michigan’s latitude is fairly high (around the 42°–45°N range), so outdoor plants get long summer days which can veg them big, but the flowering period is pushed late (September/October) when daylight wanes—hence the risk of bad weather late in the grow. In the Upper Peninsula (colder), outdoor is even more tricky; indoor grows thrive even up there.

One advantage: Michigan has abundant water resources (the Great Lakes) and decent soil in agricultural areas (the state is known for farming), so outdoor cannabis can do well in fertile spots if you manage the season. Additionally, electricity costs in Michigan are middling—not the cheapest, but not exorbitant like in some Northeast states, making indoor a viable, if not cheap, option. All said, for a premium product, most Michigan growers favor indoor or hybrid greenhouse methods to ensure top quality and avoid the whims of Midwest weather.

Wholesale prices and profitability

Michigan’s cannabis market experienced a classic boom-and-bust pricing cycle. When recreational sales started in Dec 2019, >demand initially outpaced supply, and prices were sky-high (e.g. retail ounces cost ~$400). But Michigan’s open licensing led to a rapid increase in cultivation capacity—by 2021–2022 supply caught up and then surpassed demand, causing a dramatic price crash. The average retail flower price plunged about 78% from 2020 to 2023 (from $419/oz down to $92/oz).

Wholesale prices likewise dropped sharply; by late 2022 and into 2023, reports of wholesale pounds in the $800–$1,000 range for mid-grade flower were common (with some low-quality bulk even lower). According to 2023 data, Michigan’s average wholesale flower was around $902/lb, reflecting this “race to the bottom” in pricing. For growers, this meant thin margins and fierce competition. Some large cultivators engaged in price wars, selling at break-even or loss just to keep product moving. This of course squeezed out smaller or less efficient growers, who couldn’t compete at those low prices.

The good news: Michigan’s sales volumes have grown massively (adult-use dispensaries sold ~950,000 pounds of flower in 2023—a huge jump from only ~42,000 pounds in 2020), so the total market size is big and still growing. If you can produce at scale or have a niche that commands a premium, you can make money even at lower price points. There are signs that prices may be stabilizing as some businesses consolidate or exit—2023 saw several bankruptcies and mergers, which might reduce oversupply.

Also, Michigan consumers are savvy and will pay more for top-tier quality or unique strains, which craft growers can capitalize on. In sum, profitability in Michigan is currently challenging for generic product but attainable for efficient ops or differentiated brands. The state’s relatively lower operating costs (compared to, say, Massachusetts or Illinois) help a bit—real estate and labor are cheaper in MI than on the coasts.

Viability for craft/small-batch production

Michigan is arguably one of the most craft-friendly legal markets. Why? Partly the culture: the early caregiver system (2009–2018) meant thousands of small growers honed their skills supplying patients with boutique buds. Many of today’s successful craft brands in Michigan started as caregivers. The adult-use law explicitly included microbusiness licenses for small entrepreneurs.

Furthermore, Michigan does not mandate vertical integration, so a small cultivator can exist independently and still find a retail outlet to partner with. Consumers in Michigan show strong support for local “craft cannabis”—for example, sun-grown organic flower from a small farm, or exotic genetic offerings from a boutique indoor grow, often get attention on Michigan cannabis forums and events. There are cannabis cup competitions where craft growers shine.

Additionally, the Upper Midwest connoisseur scene values potency and purity, and craft concentrates (like live rosin) made from small-batch flower are popular. Craft growers, of course, face the headwinds of low prices, but many have survived by building loyal followings or catering to high-end dispensaries. Michigan’s regulatory framework also had (at least initially) relatively low entry costs, which meant some caregivers could transition into licensed micro or Class A growers without needing millions in capital—sustaining the craft segment.

Enthusiast perspective: Michigan is known for some exceptional quality cannabis, often outperforming product from more famous states, precisely because of its craft heritage. So if you’re a passionate grower aiming to produce top-shelf, Michigan is fertile ground. Just be sure to distinguish yourself, as craft or not, you’re competing in a saturated field.

Home grow rules

Michigan’s home-grow allowance is 12 plants per household for anyone 21 or older. This is one of the highest limits of any state (most rec states cap at 4–6). Those 12 plants can yield a lot of cannabis—hence the law also lets you keep up to 10 ounces of usable flower at home (anything over 2.5 ounces must be secured under lock). The plants must be grown in an enclosed, locked space not visible to the public (basement grow tents and backyard greenhouses are fine, for example, as long as they’re secured).

Notably, this 12-plant limit is per residence, regardless of the number of adults. Medical patients and caregivers have separate provisions: a patient with a card can also grow 12 plants for themselves (and a caregiver 12 per patient as mentioned). However, you can’t stack a recreational and medical grow on the same property—it’s basically 12 max unless you’re a caregiver following those specific rules. Enforcement on personal grows in Michigan is low priority as long as people aren’t causing a public nuisance. So, home growers in Michigan truly get to enjoy the fruits of their labor, making the state a cultivator’s playground at the personal level.

Market outlook and regulatory stability

Michigan’s cannabis market is now one of the largest in the U.S. by sales, and it’s showing no signs of shrinking—but it is shifting. The regulatory environment is relatively stable: the Cannabis Regulatory Agency (CRA) has been actively adjusting rules to ensure quality (for instance, tackling a scandal with safety compliance labs inflating THC results) and to integrate the medical and adult-use markets more. They have not indicated any intent to cap licenses, so it remains an open market. Instead, we’re seeing market-driven consolidation—weaker players are exiting, and stronger ones (including some multi-state operators) are expanding.

The state’s support for social equity applicants (fee reductions, etc.) continues, though high competition makes survival tough for any new entrants. One looming issue is a recent push by some lawmakers to reduce the home-grow and caregiver allowances, under pressure from larger companies claiming diversion issues—for example, a 2022 Senate bill proposed cutting the adult 12-plant limit significantly. So far, those efforts have been beaten back (thanks to advocacy by groups like Michigan NORML and consumers who cherish their home-grow rights). It’s something to watch: if large producers lobby successfully, the caregiver/home-grow model could be curtailed, which would alter the craft landscape.

In the near term, expect Michigan to keep trending toward a mature market: more retail stores (741 and counting), refined product offerings, and possibly price stabilization as some surplus shakes out. From a grower’s perspective, Michigan is still one of the most welcoming states—if you’re enthusiastic and knowledgeable, you can find a niche here. Just be prepared to hustle, innovate, and compete, as the Midwest Green Rush has transitioned into a marathon rather than a sprint.

New Mexico – High Desert, Higher Potential 🏜️

Cultivation Laws & Home Growing

New Mexico legalized recreational cannabis via the 2021 Cannabis Regulation Act (effective June 29, 2021), making it the 18th state to do so. Medical cannabis was first allowed (under a research program) in 1978 and was expanded to a full medical program in 2007.

Adults 21+ may possess up to 2 ounces of flower and cultivate up to 6 mature plants (plus 6 immature seedlings) at home. (This amounts to a 12-plant household cap.) Medical patients similarly can grow at home; in practice the adult-use home-grow rules effectively superseded the old medical limits. Patients may buy up to 15 oz (425 units) per 90 days tax-free, but beyond quantity, medical card holders benefit mainly from tax exemption (no excise tax on med cannabis).

Commercial cultivation is regulated under a unified framework. There are no plant-count caps for licensed growers (except the microbusiness tier), but all producers must prove legal water rights. Outdoor farms and greenhouse operations need irrigation water rights from the NM Office of State Engineer; indoor grows require industrial water (domestic wells only cover personal grows). Zoning laws apply: grows must be in secure, enclosed facilities out of public view. Generally, personal grows are legal if plants are hidden from public view and secured.

Licensing Framework & Market Structure

New Mexico set up a tiered licensing system under the Regulation & Licensing Department’s Cannabis Control Division (CCD). The law created 10 license types (cultivation, manufacturing, retail, consumption lounges, couriers, and microbusiness variations). Two cultivator licenses dominate: the standard Producer License (unlimited plant count, higher fees) and the Cannabis Producer Microbusiness (cap 200 mature plants, lower fees).

There are also Integrated Microbusiness licenses that allow small operators to combine growing with one or two other activities. Applicants must complete background checks and obtain local approvals. The Cannabis Control Division is now active statewide (first reached by April 2022) licensing and enforcing all cannabis businesses.

Importantly, NM’s launch was extremely open: instead of lottery or tight caps, virtually anyone meeting criteria could obtain a license. New Mexico took a straightforward approach, making it easy for anybody who wanted a license to obtain one. Social equity was “built into the DNA” of the law (no separate equity quota was needed). The result is license glut: over 2,000 cultivation/manufacturing/retail licenses were approved in the first two years, including 1,000+ dispensary licenses (for comparison, larger Colorado has ~900 active retailers).

In September 2024, NM had issued so many licenses the market became oversaturated, and legacy operators (pre-2021 businesses) are closing dozens of stores. The state has begun revising rules (e.g. revoking non-compliant licenses) to rein in bad actors.

Climate & Growing Conditions

New Mexico’s high-desert climate is defined by abundant sunshine, low humidity, and warm summers—an enthusiast’s dream for outdoor and greenhouse grows. The state’s sunny days and overall climate make it ideal for outdoor grows, as opposed to indoor grows that require more lighting and humidity control. With roughly 310+ sunny days/year (especially in southern NM and the Rio Grande valley), outdoor/greenhouse crops can flourish during the long summer season. Many local cultivators are now growing in large sunlit greenhouses or in outdoor fields with drip irrigation (NM’s famed chile farms use similar methods). The aridity means water must be carefully managed, but also that mold and pests are less prevalent.

However, the flip side is cold winters and short days. Frost can occur in winter, so outdoor grows are essentially seasonal (plant after last frost in spring, harvest by early fall). Some growers do two outdoor crops per year by using fast-flowering varieties, but most rely on greenhouses to extend the season into winter. Indoor cultivation (in warehouses) is technically possible but energy-intensive in NM’s climate (heating/cooling needs are significant) and requires strict water rights.

In general, greenhouses and solar-powered indoor ops appear to be the sweet spot for NM farms—harnessing the sun while buffering against temperature swings. Local bragging rights: one executive boasts that NM’s “outdoor, sun-kissed flower and living soil” rival top-quality sun-grown cannabis anywhere in the world—it’s the state’s hope to one day be as famous for its bud as it is for green chile.

Wholesale Prices & Profitability

Like other young markets, New Mexico has seen wild price swings. Early on (2022) flower sold for premium levels, but by 2023 prices plunged under heavy competition. According to industry reports, quality outdoor-grown flower was fetching only about $1,000–$1,200 per pound in 2023—and that was before brokers started undercutting with gray-market supply. (For context, illicit out-of-state flower can sell for ~$300/lb and still flood the market via loopholes.) Wholesale distillate fell similarly (dropping from about $9,000/L in early 2023 to ~$4,000/L by late 2023).

Profitability for NM growers is thin. The excise tax on recreational sales is a relatively low 12% (plus local 6–10%) and medical sales are tax-exempt, but oversupply means slim margins. Large-scale producers benefit from economies of scale, but smaller cultivators face razor-thin returns unless they carve out a premium niche. Indoor cultivation typically commands higher prices (often double outdoor rates) but also eats operating costs. Growers also note that audit controls (seed-to-sale tracking) and hefty fees/renewal costs (up to $75K for a cultivation site) eat into profits. In short, NM is currently a “low-price market,” so tight operations, direct-to-dispensary sales, or value-added products (edibles/concentrates) are key to staying in the black.

Craft Growers & Small Producers

New Mexico’s open-entry approach has made it very hard for craft growers to thrive—they’re competing against a flood of production. With hundreds of small gardens and industrial farms online, market share is split thinly. However, the industry narrative is shifting to help them.

New Mexico Cannabis Chamber of Commerce leaders stress the need to “create supports and funding for small and medium-sized operators, so it’s not only MSOs [multi-state operators] left standing” as the market consolidates. In practice, this means some wholesalers and co-ops are starting to carve out local varietal brands (e.g. high-THC artisanal flower, CBD/terpene-rich cultivars) that can command a bit of premium.

Hobbyists and “craft-batch” suppliers often focus on greenhouse sun-grown or specialty organic methods—leveraging NM’s ideal solar climate to differentiate quality. That said, newcomers should be aware that scale matters: many small producers currently make only token margins. Securing direct supply contracts with dispensaries or tapping niche markets (medical patients, extracts) is often the route for survival. With regulators reportedly tightening enforcement on illicit flower, local growers do have an edge in being fully licensed—but they will still need business acumen, as “everyone’s making a gummy” in the wholesale market.

Home Grow Rules

Under NM law, any adult 21+ may grow at home (regardless of medical status), subject to the 6/6 plant limit. There is no separate “medical-only” home-cultivation limit now—the recreational limit is universal. However, medical cardholders do have higher purchase allowances and pay no sales tax on purchases, which means some home growers rely on the dispensary system for larger needs.

All home grows must be in a secured, non-public area. Importantly, landlords and utilities cannot prohibit indoor personal grows under NM law. (Only a city or county zoning ordinance might restrict home gardens.) The state also requires growers to keep plants under continuous surveillance—in practice this means a locked, windowless grow room or fenced yard. Odor control measures are technically required but largely unenforced.

Market Outlook & Regulatory Stability

New Mexico’s adult-use market is only a few years old, and it has already shown both promise and pain. In the first year (Apr 2022–Apr 2023), adult-use sales soared (over $300 million combined with medical) and dispensary count swelled. But by late 2023, industry watchers warn of a “destabilizing” oversupply: too many retailers and growers chasing a small population. Prices have stayed low, and some smaller businesses have folded. Regulators (CCD) are aware: in 2023 they revoked several licenses for rule violations (e.g. selling out-of-state product) and continue to audit the market for compliance.

Legally, the framework remains largely intact. The main laws (HB2 of 2021) are recent and not under repeal; instead, the focus has been on tweaking implementation (e.g. closing traceability loopholes for illicit imports, adjusting license categories). Some local jurisdictions (like Albuquerque) have passed new zoning and public-use rules. Overall, policy stability is moderate: we expect the legislature to make incremental fixes (such as refining the tier system, enhancing funding for enforcement, or adjusting taxes) rather than wholesale rewrites. Many believe NM will learn from other states’ growing pains: oversupply, regulatory under-resourcing, and illicit competition are already on the agenda.

Looking ahead, New Mexico’s cannabis industry has real upside potential—if it can balance growth with sustainability. The industry’s advocates often invoke NM’s unique advantage: the high desert’s sun and soil produce excellent cannabis, just like they do award-winning chile and chile wines. If the state can tighten its oversight and support viable small growers, NM could evolve into a premium craft market with competitive brand identity (imagine “New Mexico bud” exports alongside green chile). For now, the outlook is cautious: short-term challenges abound (consolidation, price pressure), but long-term prospects hinge on smart regulation and entrepreneurship.

Massachusetts – East Coast Green 🎓

Massachusetts holds the distinction of being the first state on the U.S. East Coast to legalize recreational cannabis (voters approved it in 2016, sales began in 2018). As such, it became a pioneer for cannabis cultivation in the Northeast—a region with a very different climate and market dynamic than the West Coast.

Massachusetts has developed a fairly robust cannabis industry, balancing moderate licensing openness with rigorous regulations. For growers, Massachusetts offers opportunities in both large-scale cultivation and small-batch craft operations, albeit with higher costs and some unique challenges (like New England weather!). It’s a state where indoor grows dominate, but outdoor and greenhouse cultivation are slowly making inroads as well.

Laws and home cultivation

Adults 21+ in Massachusetts can legally grow 6 cannabis plants at home (or up to 12 plants per household) if two or more adults live together. This is on par with Arizona and more generous than states like Oregon (which only allows 4). Home growers must keep their plants locked and out of public view; a violation (growing too many or having them visible) can result in a civil fine up to $300 and forfeiture of the excess plants.

On the commercial side, Massachusetts licenses cultivators in tiers based on canopy size—Tier 1 is up to 5,000 sq ft, Tier 2 up to 10,000 sq ft, and so on, with the largest Tier 11 allowing up to 100,000 sq ft. Initially, there was a limit that a single entity couldn’t own more than 3 cultivation licenses or a total canopy above a certain square footage, to prevent monopolization.

There’s also a unique Craft Cooperative license: a group of small cultivators can band together to share a cooperative license, collectively cultivating up to the largest tier size, but spread across multiple locations (this was meant to help small farmers participate). Massachusetts also started with a provision that microbusinesses could be licensed—these can have a canopy up to 5,000 sq ft and can also do product manufacturing with their own crop.

The state did not cap the number of licenses, but each license must get not only state approval but also sign a Host Community Agreement (HCA) with the town or city it’s in. That local control aspect means some towns limited the number of grows or banned them altogether. So, effectively, the licensing is moderately accessible but comes with layers of approval and often stiff local fees or community impact payments.

Licensing and fees

Getting a cultivation license in Massachusetts involves an application to the Cannabis Control Commission (CCC) and negotiating with a municipality for an HCA. Application fees are relatively low ($100–$600 depending on license type), and license fees range from $625 (Tier 1 outdoor) up to $25,000 (Tier 11 indoor), with increments in between. This isn’t prohibitively expensive on paper, but the real costs come in building out facilities, navigating bureaucratic hoops, and Massachusetts’ generally high cost of doing business (think pricey real estate, high labor costs, etc., especially near Boston).

Many early applicants found the process slow—it could take a year or more from applying to actually receiving a final license and commencing operations. By 2020-2021, more cultivation came online and things picked up. There are now dozens of cultivation sites across the state, including some very large greenhouse complexes in western MA and some boutique indoor grows servicing the Boston area.

Massachusetts also implemented social equity programs to assist disadvantaged groups in entering the industry, and certain smaller licenses (like microbusinesses) got benefits like reduced fees and expedited review. Overall, licensing is competitive but achievable; the state has not experienced an oversaturation of licensees—in fact, some argue supply is still somewhat constrained in Massachusetts because of capital and local approval bottlenecks.

Climate and growing conditions

Massachusetts has a New England climate—meaning cold winters, relatively humid summers, and the looming threat of nor’easters and hurricanes during shoulder seasons. Outdoor growing is possible, but the window is short. Typically, you’d plant (or move clones/starts outdoors) after the last frost in late May, and you need to harvest by early October at the latest in most of MA, because October brings chilly nights and often lots of rain (and sometimes an early frost or even a freak snow). The humidity in late summer can invite mold (powdery mildew and bud rot are common outdoor issues). That said, some hardy growers do cultivate outdoors, especially in the more rural western part of the state. They often use mold resistant strains or autoflower varieties that finish faster.

The results can be decent, but generally Massachusetts outdoor bud can’t match the perfect conditions of, say, California sun-grown. Thus, indoor cultivation is predominant—Massachusetts has numerous indoor facilities, many in retrofitted warehouses or even former mills. These produce consistent, high-THC flower year-round. Greenhouse cultivation is a growing trend too: for example, there are hybrid greenhouses with supplemental lighting and heating that take advantage of summer sun but can carry plants through cooler periods.

Massachusetts has a lot of skilled horticulturalists (coming from its history with other greenhouse crops in New England) applying that knowledge to cannabis. One factor to consider is energy cost: Massachusetts has some of the highest electricity rates in the country, which makes indoor growing expensive. This has pushed people toward energy-efficient LED lighting and solar panel installations to offset grid costs. Water is plentiful (no shortage of rain overall), but one must often filter or treat it for indoor use (the tap water in some places may be chlorinated or hard).

In summary, growing in MA is very doable but usually within controlled environments. If you’re doing a small craft grow, you’re likely indoors or in a sealed greenhouse to ensure quality. The outdoor season, while limited, could be an option for those looking to produce lower-cost bulk (for extraction or edibles), since outdoor yields can be high per plant even if quality is lower.

Wholesale prices and market conditions

Massachusetts started adult-use sales with sky-high prices due to limited supply. Retail ounces initially cost $300–$400. Over the next few years, prices fell significantly as more cultivation came online. From 2020 to 2023, the average adult-use flower price per ounce dropped 56% (from ~$394 to $173). By 2023, retail prices were roughly in the $180–$220/oz range in many dispensaries. Wholesale prices also declined accordingly. In 2023, average wholesale flower in Massachusetts was around $1,129 per pound—higher than places like Colorado or California, reflecting that supply in MA is still tighter (and costs are higher). Massachusetts growers, especially early on, enjoyed very healthy margins.

Even as prices fell, many cultivators could sustain profit because their product was still moving at reasonable rates. However, by 2023 some cultivators did start feeling a pinch, as the market got more competitive and production outpaced demand slightly. There were reports of excess inventory and some wholesalers dropping prices to move product. Still, Massachusetts has not seen anything like the glut of the West. The limited number of total dispensaries (there were 259 adult-use retailers by late 2024) and the moderate number of cultivators means the market is relatively balanced.

Profitability potential remains good, especially for efficient operations or those producing top-tier flower which can still command a premium. One interesting dynamic: Massachusetts borders other populous states (New York, Connecticut) that later legalized and are still ramping up their industries, so Massachusetts has been something of a regional source—though legally, cross-state trade is not allowed, there’s anecdotal evidence of MA products finding their way to consumers in neighboring states. This “gray market demand” likely kept wholesale prices higher than they would be if all neighboring states were fully saturated. In short, Massachusetts’ wholesale prices are declining but not crashing—and in 2024–2025 they might stabilize as weaker growers exit and the market finds equilibrium.

Viability for craft growers

Massachusetts actively tried to foster craft and small-scale growers with the microbusiness and co-op license categories. The success has been mixed—high costs and bureaucracy still make it hard for a true small farmer to thrive, but some have managed. There are a few craft cooperatives now operating, where groups of legacy growers combined efforts.

Additionally, consumers in Massachusetts (especially around Boston and college towns) create strong demand for premium, artisanal cannabis—think organically grown, unique terpene profiles, limited batch drops, etc. The state hosts competitions and cannabis cups that celebrate craft quality. Some dispensaries specialize in local craft products, giving shelf space to smaller producers with interesting strains. So the market is there for craft cannabis. The key is surviving the regulatory overhead; for example, a microbusiness still has to comply with the same testing, security, and METRC tracking requirements as larger ones, which can be costly. But if a craft grower can secure financing and a supportive town, they can carve out a niche.

Massachusetts customers are known to appreciate boutique buds (perhaps a reflection of East Coast connoisseurs finally getting to choose quality after years of illicit scarcity). The viability is also supported by the fact that the illicit market (which was strong in MA historically) is gradually shrinking as legal options multiply—discerning consumers tend to shift to legal high-quality product, benefiting licensed craft growers. All in all, Massachusetts is a fair playing field for craft cultivators relative to many states: not entirely easy, but definitely possible if you bring cultivation skill and business savvy.

Home grow rules (personal use)

As mentioned, an adult can grow 6 plants (or 12 per household) in MA. People have taken advantage of this, often setting up basement or attic grow tents. Given the climate, most personal growers do it indoors with lights—though a hardy few use their backyard gardens in the summer to grow a few monster plants (with the understanding they have to finish before the October weather turns).

The law allows one to possess up to 10 ounces of cannabis at home harvested from their plants (any excess beyond an ounce must be secured). Massachusetts has a fairly chill attitude toward home grows as long as you stick to limits—neighbors might complain if it’s visible or smelly, but legally you’re protected if you follow the rules. Of course, the power bills for running an indoor home grow in MA aren’t trivial, but many enthusiasts find it worth it for a personal stash of buds come harvest.

Market outlook and regulatory stability

Massachusetts’s cannabis market is maturing and stabilizing. The initial boom of “first legal on the East Coast” has passed, and it’s now about steady growth and competition. The regulatory body (CCC) has faced some controversies and churn (including investigations into the HCA process and alleged bias), but overall the framework is set and isn’t likely to undergo radical changes. One recent development: in late 2022, a law was passed to rein in those Host Community Agreements—towns were charging cannabis businesses exorbitant “impact fees,” and the new law limits those fees only to actual documented costs. This is a positive sign for the industry’s sustainability, as it curbs some municipal profiteering.

Another development is the entry of New York’s market in 2022–2023; as NY ramps up, some predict Massachusetts might see a dip in sales (fewer New Yorkers driving up to buy). But Massachusetts has built a solid in-state consumer base, and new product types (like edibles, beverages) are expanding. The outlook for cultivators is that there may be some shakeout of less efficient growers, but demand for quality flower remains high. If federal legalization or interstate commerce were to happen, Massachusetts-grown cannabis might not be as competitive cost-wise as West Coast due to higher production costs, but being an early East Coast hub, MA companies might pivot to processing or retail.

In the foreseeable future, Massachusetts is likely to remain one of the top cannabis markets outside the West Coast, with cultivators benefiting from moderate wholesale prices and a knowledgeable consumer base. Regulatory stability is medium-high; expect incremental changes (like possibly easing entry for smaller growers, more social equity measures, etc.) but no dramatic license caps or anything—the state seems content with how the industry is evolving. For growers who love a challenge and the satisfaction of producing dank buds in a less-than-ideal climate, Massachusetts is an exciting place to be, combining a bit of grit with a lot of opportunity in the cannabis cultivation scene.

Oregon – Oversupply and Terroir in the Pacific Northwest 🌲

Oregon is a tale of two cannabis worlds: on one hand, it’s an old-school growing paradise with a climate in parts of the state that’s superb for cannabis (especially in Southern Oregon), a long history of cultivation, and a community that cherishes craft weed. On the other hand, Oregon’s legal market has become notorious for oversupply and rock-bottom prices—a double-edged sword for growers.

Recreational cannabis has been legal since 2014 (sales started 2015), and Oregon had a thriving medical program even earlier. The state adopted an open licensing approach like Oklahoma and Michigan did, but with a much smaller population to absorb product, leading to way more weed than Oregonians could ever use.

For cultivators, Oregon offers low barriers to entry and low operating costs, but profitability is challenging unless you’re extremely efficient or have something special to offer. Still, Oregon remains one of the best places to actually grow cannabis (in terms of plant health and environment)—if only they had more customers or could legally export out of state!

Laws and limits

Adults 21+ in Oregon can grow up to 4 cannabis plants per household for personal use. (Many advocates find that number low, but it is what it is—notably less than neighboring California or Nevada allow.) Medical patients can grow more; a registered Oregon medical patient can cultivate up to 6 mature plants at a time (and additionally some immature) at a registered grow site, either for themselves or have a caregiver do it.

Commercially, Oregon’s regulatory body (the OLCC—Oregon Liquor and Cannabis Commission) initially had no statewide cap on licenses, similar to Oklahoma. Hundreds of grow licenses were issued between 2016–2018. By mid-2018, seeing the glut, the OLCC paused new license processing, and in 2019 the legislature imposed a moratorium on new producer licenses. That pause was extended by HB 4016 (2022) and, most recently, by HB 4121 (signed March 20 2025), which stretched the freeze through December 31 2024 and then converts it into a per-capita licensing cap: one production or retail license per 7,500 adult residents and one processor or wholesaler license per 12,500 adults.

Existing licenses can still renew or transfer, but brand-new applicants are locked out until the active count drops below those caps. There are tiered license sizes based on canopy: Tier I (small) and Tier II (large), with separate categories for indoor, mixed, or outdoor to account for canopy area (indoor canopy is measured smaller for equivalent production).

For example, a Tier II outdoor might allow up to 40,000 sq ft, whereas Tier II indoor is around 10,000 sq ft—acknowledging that indoor yields more per square foot. These tiers allowed both modest family farms and bigger operations. No single entity can hold more than a certain number of licenses (to curb monopolies), though that’s been tested with creative business arrangements. Overall, Oregon was for a time the easiest place to get a license—just pay the ~$1,000 application and license fee, meet the requirements, and you were in. That ease, combined with many talented legacy growers coming into the legal fold, led to a vibrant but overcrowded producer market.

et.

Climate and growing conditions

Oregon’s climate is excellent in some regions for outdoor cannabis. Particularly, Southern Oregon (Jackson and Josephine Counties) has a Mediterranean-like climate (warm dry summers, not too much rain until mid/late fall) very akin to Northern California’s Emerald Triangle. Many sungrown farms thrive there, and the concept of cannabis terroir is big—e.g. “Applegate Valley” or “Willamette Valley” weed, similar to wine regions. In the Willamette Valley (around Eugene, Portland, etc.), the summers are also dry and warm, but the fall can get rainy earlier, so mold at harvest is a risk; still, plenty of people grow outdoors and in greenhouses with success. Eastern Oregon is high desert—lots of sun and very arid, but cooler nights; outdoor can work but water is needed.

The upshot is, Oregon can produce amazing outdoor cannabis—dense, high-THC buds from full-season plants—arguably better than anywhere except California’s best spots. This means greenhouse and outdoor cultivation are very viable, with relatively low costs compared to indoor. Indeed, Oregon historically has cheap electricity (thanks to hydroelectric power), which also benefits indoor growers. Many large indoor facilities were built around Portland and elsewhere, but some have struggled because competing against outdoor prices became tough. Indoor is still used for top-shelf or year-round production of certain strains, but a lot of Oregon’s supply is outdoor/light-dep. The fertile soil in parts of Oregon, combined with the legacy knowledge of growers, yields high-quality organic product.

The state is also very cannabis-friendly culturally, so things like regenerative farming, solar-powered grows, etc., are common. Pests and molds exist (outdoors you have to worry about botrytis if rains come late, and indoor you have typical issues like spider mites), but nothing extraordinary beyond standard cultivation challenges. In the Pacific Northwest, one unique issue is light pollution—outdoor farms have to be mindful of neighbors and dark sky rules if using greenhouse lights at night (some communities have ordinances now because bright greenhouse lights were lighting up rural skies). Summing up: from a pure growing perspective, Oregon is top-tier—you can grow outdoors almost as well as in California’s famed regions, and indoors with cheaper power than many places. It’s a growers’ playground, were it not for the market economics.

Oversupply and wholesale prices

Here’s the catch—Oregon’s production has far exceeded its in-state consumption. By how much? It’s been estimated that Oregon growers have produced twice as much (or more) cannabis as the state market can use in recent years. The result: Wholesale prices plummeted. At their low in 2019, some outdoor wholesale pounds were reportedly going for as little as $300. Many farms could not turn a profit at those prices. The state actually had to do things like permit producers to transfer excess product to the medical market or make more concentrates to reduce flower oversupply.

According to data, the average wholesale flower price in Oregon in 2023 was about $1,047 per pound—but that average masks a huge range. Craft indoor might still fetch $1,500+, while outdoor might be a few hundred bucks. Prices ticked up a bit in late 2022/early 2023 due to some growers exiting the market and perhaps smaller 2022 harvests, but not by much. Retail prices are very low too—Oregon has some of the cheapest legal weed in the nation. Example: the average retail price per gram was under $4 by late 2023, meaning an ounce might cost consumers $100 or less for decent quality. This means profitability is razor-thin. Only those with extremely low cost of cultivation (outdoor growers with efficient setups, perhaps growing at < $100/lb cost) or those who can command a premium (unique strains, craft branding) survive.

Many small farms have closed shop; the ones that remain often diversify into processing (making extracts, which can use up surplus flower) or survive on slim margins. The state did freeze new licenses which helped prevent further saturation, but the damage is sort of done—there’s just a lot of cannabis. Some optimistic growers are holding out for interstate commerce legalization, hoping to export Oregon’s excess to other states in the future (Oregon even passed a law in 2019 to allow export if federal law changes). If that ever occurs, Oregon growers could boom by supplying places less ideal for growing. But until then, it’s tough. So, from a business view: Oregon offers perhaps the cheapest wholesale prices in the U.S. (apart from maybe Oklahoma’s glut) and thus the lowest profit per pound for growers.

Viability for craft growers

Culturally, Oregon is all about craft. The consumer base appreciates sun-grown organic flower, rare heirloom strains, and ethical farming. In theory, craft growers should thrive here. The problem is the prices are so low that even craft product doesn’t make lots of money. But some craft growers have managed to stand out: for instance, breeders who develop new strains in Oregon often gain fame and can sell their boutique seeds or clones (a side revenue for craft folks). Also, some Oregon craft flower finds its way (legally or illicitly) to connoisseurs out of state who pay higher prices, indirectly supporting those growers.

The state has an “Oregon Craft Cannabis” designation effort and the idea of cannabis appellations (like wine) to promote regional craft quality through marketing. It’s forward-thinking, but until the oversupply issue is solved or out-of-state sales open up, craft farmers are largely doing it for passion as much as profit. Some have pivoted to the high-end extract market—e.g., making live rosin or hash from their craft flower, which can fetch more per pound input. Oregon is known for excellent concentrates, often from small makers sourcing from craft farms. So viability is there if you can be creative and ultra-quality-focused.

Another factor: Oregonians are loyal to local businesses; craft brands with a story (sustainably grown by a family farm, etc.) do get local love. They might not outsell a bargain ounce at $50, but they carve a loyal niche. In summary, craft cannabis in Oregon is alive and well in spirit, but financially it’s a grind and really only viable for those who have extremely efficient operations or diversified products.

Home grow rules

Oregon’s home cultivation rule of 4 plants per residence is relatively modest. It’s straightforward and one of the earlier states to allow any home grow (as rec was legal in 2015, home grow was from the start). Many Oregonians take advantage of it—growing a couple plants in the backyard or a tent. The climate in much of Oregon is kind enough that outdoor home grows can yield good results if timed correctly (for example, folks in southern OR can plant outdoors and get nice trees by fall).

Indoor home grows are also common, especially to keep something going year-round. With legal dispensaries being so affordable, home growing in Oregon is perhaps less economically motivated (why grow when you can buy cheap?), but enthusiasts do it for the love of cultivation or to grow specific strains. Medical cardholders can grow more—6 mature plants—and they often did under the old OMMP (Oregon Medical Marijuana Program). In fact, prior to rec legalization, Oregon’s medical grow scene was prolific, with some patients growing far more than needed and supplying dispensaries. The state cracked down on diversion by integrating medical grows into the tracking system if they were above a certain plant count. Now, personal medical grows persist but are smaller scale.

Market outlook and stability

Oregon’s cannabis market is stable in regulation but saturated in product. HB 4121 (signed March 20 2025) converts that moratorium into the per-capita licensing cap after December 31 2024, beefs up joint hemp inspections, and effectively keeps new applicants on ice while tightening compliance requirements. The number of active growers is slowly decreasing as some give up—which, cruel as it is, might actually help the remaining ones by reducing supply.

Oregon’s outlook may improve if more people consume more (though Oregonians already have high usage rates per capita) or if the state finds a way to offload excess (like more processing into non-flower products, or eventual export). Without those, the surplus will continue. However, from a cultivation perspective, Oregon isn’t going anywhere—it will remain a hub of cannabis growing expertise and innovation.

The regulatory environment is reasonably friendly (low fees, supportive of small business), aside from the license pause. Should demand and supply ever rebalance, Oregon could again be very lucrative to grow in because costs are low. Many eyes are on federal changes; Oregon even has compacts drafted to potentially trade with California or Washington if allowed. If that day comes, Oregon’s currently overstocked warehouses could empty rapidly into eager new markets. Until then, growers are hunkering down, focusing on efficiency or differentiation. So the market outlook: persistently low prices, gradual attrition of producers, with hopes pinned on external change.

For a grower deciding where to set up shop, Oregon is ideal agronomically and lifestyle-wise (beautiful environment, supportive community), but one must be ready for the economic reality of slim profits in the short term. As a passionate grower, though, it’s somewhat of a Mecca for cannabis cultivation—many still choose Oregon for the love of the plant, if not for the love of quick riches. 🍃

Maine – Craft Cannabis Haven of the Northeast 🦞

Maine, the northernmost state in the Eastern U.S., has a small but mighty cannabis scene that is often celebrated for its craft quality and caregiver-centric culture. Recreational cannabis sales began in Maine in 2020 (it was legalized by voters in 2016, but took a few years to launch the market), and Maine has had a medical program since 1999—one that became known for empowering individual caregivers to grow and supply patients.

For cannabis cultivators, Maine offers a more boutique, small-scale landscape compared to big markets like California or Colorado. It’s a place where craft growers shine, aided by relatively flexible rules and a consumer base that values locally-grown product. However, Maine’s chilly New England climate and limited population present some challenges, and recently even Maine hasn’t been immune to oversupply issues in its medical market. Let’s unpack what makes Maine one of the best states for growers.

Laws: medical vs. recreational cultivation

Adults 21+ in Maine can home cultivate up to 3 mature cannabis plants, 12 immature (veg) plants, and unlimited seedlings for personal use. This unique phrasing essentially means you can have 3 flowering plants at a time for yourself (plus those younger ones growing to take their place). While 3 mature plants isn’t a lot, Maine’s thinking was likely to allow a continuous cycle with the 12 immatures. As for possession, adults can have up to 2.5 ounces of usable cannabis.

Under Maine’s medical program, a registered caregiver (or patient growing for themselves) historically could grow up to 6 mature plants per patient. Caregivers often served multiple patients (up to 5), so some had fairly sizable grows, and no plant limit if they had enough patients. Maine’s medical caregivers essentially operated like small businesses, supplying either directly to their patients or, after a 2018 reform, selling excess to dispensaries or other patients.

The rec market licenses are separate: Maine issues cultivation licenses in tiers. Tier 1 can be up to 500 sq ft canopy or up to 30 plants (they even allow a plant-count-based micro license); Tier 2 up to 2,000 sq ft; Tier 3 up to 7,000; Tier 4 up to 20,000 sq ft. This tier system allows gradual scale—interestingly, Tier 1 has a super-cheap license for small growers (just $100 application and then fee per plant if using plant count). Maine wanted to bring some of those caregivers into the adult-use market by lowering the barriers for the smallest tier. A quirk: Maine’s law lets each adult also gift up to 2.5 ounces of cannabis to another adult (no remuneration), which fosters a bit of an informal market among home growers and caregivers sharing their harvests.

Licensing and accessibility

Maine’s adult-use industry got off to a slow start partly because of local opt-in—towns must actively allow cannabis businesses. Many rural towns were cautious at first. So, while the state itself was not capping licenses much, the local approvals limited how many cultivation sites opened. Fees in Maine are quite low compared to other states (as mentioned, $100–$500 application, and annual license fee ranging from a few hundred dollars for the smallest to $30k for the largest Tier 4 indoor). This is very accessible—it’s one of the lowest cost states to start a grow.

Maine also favors local ownership; there was initially a residency requirement for owners (though that got challenged in court for being unconstitutional, it was dropped for adult-use, but Maine companies are still largely local). The caregiver system (medical) still exists robustly alongside the rec market. As of 2023, Maine had thousands of registered caregivers who collectively serve far more medical patients than the eight licensed medical dispensaries do. Many of these caregivers are essentially micro-cultivators, growing craft cannabis in small batches. They can sell to their patients or in some cases through caregiver storefronts (a quasi-gray area Maine had for “medical caregiver shops”).

The adult-use market, on the other hand, saw about 100+ licensed cultivation facilities come online by 2022–2023, mostly smaller tiers. Maine’s approach thus heavily supports small to mid scale growers and hasn’t (yet) been overrun by huge corporate grows. The structure is such that if you’re a passionate grower in Maine, you can get a license and start small fairly easily compared to, say, a state like Florida or Illinois.

Climate considerations

Maine’s climate is cool and short-season. Outdoor cultivation is limited by a much shorter summer. Frost can arrive in September in northern parts, and even southern Maine (coastal) by early October. Maine also has quite a bit of humidity and rain, especially in late summer/fall when hurricanes or storms can send remnants up the coast. This means pure outdoor growing is a gamble and often results in lower yields due to early chop or mold issues. Nevertheless, some hardy Maine growers do outdoor or light-dep greenhouses, especially with early-finishing strains or auto-flowering varieties that can be harvested by late August or early September. Maine’s latitude (~43–47°N) gives long summer days (great for vegetative growth), but flowering needs to be timed before cold sets in.

For reliable, quality production, indoor cultivation is prevalent in Maine. Many caregivers and licensed growers operate indoor grow rooms or hoop-house style greenhouses that can be climate-controlled. One advantage: Maine’s cooler average temperatures can help with indoor climate control in summer (not as extreme heat as, say, Arizona). But winters are cold, so heating can be an issue for any greenhouse grows year-round. Power costs in Maine are moderate-to-high (New England electric rates are up there), which is a downside for indoor. However, Maine has relatively cheap real estate and lots of rural land, which lowers overhead. Also, the water quality is good (plentiful clean groundwater).

Maine’s environment lends itself to organic, soil-based growing—lots of farmers have adopted living soil techniques in big barns or outdoor plots. Pest-wise, Maine doesn’t have some of the intense pest pressures of warmer climates, but indoors you still have to watch out for typical culprits (mites, molds). The state’s agriculture background (think blueberries, potatoes) means a decent knowledge base in horticulture. So climate-wise: Maine is not ideal for outdoor (too short a season for full-term plants), but perfectly fine for indoor, and the cool climate can actually make managing indoor heat easier except in the depths of winter when heating is needed.

Wholesale prices and market

Maine’s cannabis market, especially adult-use, is relatively small (population ~1.3 million plus some tourist influx). In 2022, adult-use sales were about $250 million, which is big for Maine but small compared to say Massachusetts next door. As more cultivators have come online, prices have declined. On the medical side, Maine saw a significant oversupply and price drop in 2022–2023: wholesale prices fell and a lot of caregivers struggled to sell their product, especially as some medical customers shifted to the recreational stores or caregivers faced more competition. The Maine Office of Cannabis Policy reported “oversupply of product/lower prices” was the top reason caregivers were not renewing licenses. Many medical caregivers couldn’t get rid of all their harvest or had to slash prices, making it hard to cover costs (especially with rising electricity and utility costs).

In adult-use, retail prices are coming down too: from 2020 to 2023, Maine’s average retail ounce price dropped about 51% (from $449 to $222), which indicates a big shift toward affordability. Wholesale data specific to Maine isn’t widely published like other states, but we can infer if retail ounces are ~$222, wholesale per pound might be in the ballpark of $1,200 or less (depending on markup structures). It’s likely that top-shelf craft cannabis still commands a premium, but the general market probably sees decent indoor pounds going for maybe $1,000–$1,500, with outdoor/light-dep and bulk trim much less. Maine’s small market size means even a modest number of new growers can tip into oversupply.

Profitability for growers is not as flush as in limited-license states; it’s more akin to Oregon’s scenario but on a smaller scale. However, Maine growers often rely on direct-to-consumer models (especially caregivers) which allow them to capture more of the value rather than wholesale. If a caregiver can sell their own product directly to patients at, say, $200/oz, that’s effectively $3,200/lb retail, far above wholesale—and some do manage that by building loyal patient clientele.